Artificial intelligence (AI) is a software technology that usually relies on large amounts of data that is fed to smart algorithms for making informed choices. It is not black magic that solves all the problems of the world, but AI … Read the story...

Tag: industry

5 travel and tourism megatrends reflect the rise of new technologies, businesses and prospering nations

Travel and tourism is already one of the largest, yet also one of the fastest growing global industries. It was estimated to account for about 10% of global GDP in 2017. Entire regions depend on the arrival of tourists, like … Read the story...

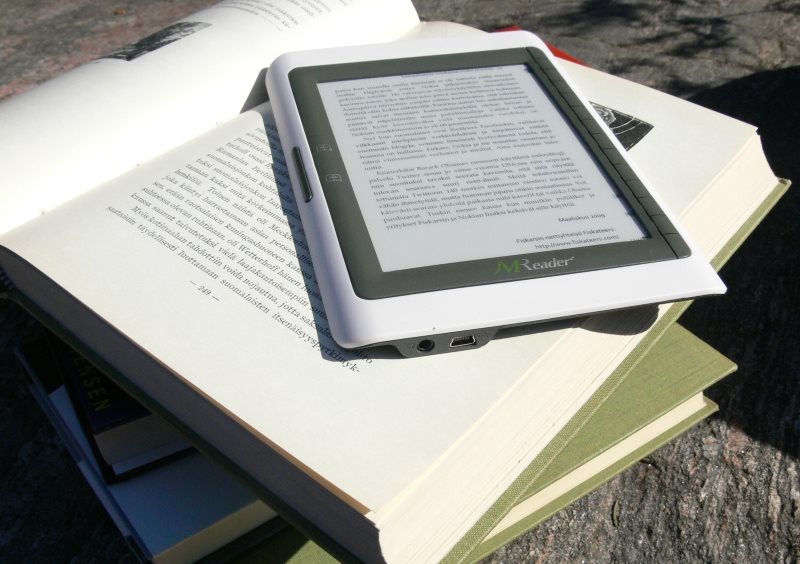

Trends in book business: small publishers win big traditional publishers in specific ebook genres

A new report on the state of the ebook, audiobook and print book markets in the US was recently delivered by the number-crunching wizard Data Guy at Digital Book World Conference 2018. The statistics – that cover almost the … Read the story...