A new report on the state of the ebook, audiobook and print book markets in the US was recently delivered by the number-crunching wizard Data Guy at Digital Book World Conference 2018. The statistics – that cover almost the entire online books sales in the US – indicate that readers of different book genres have vastly different preferences on book formats. Let’s analyze book publishing trends that can be identified from the Data Guy’s statistics.

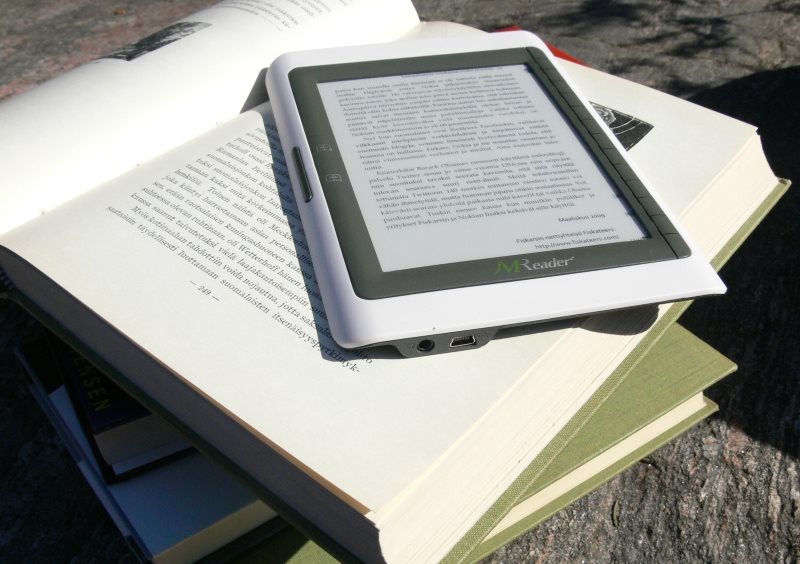

Strong sales of ebooks and audiobooks continue

The Author Earnings report measures ebook, audiobook and print book sales in the US online bookstores from April 2017 until September 2018. The total sales during these 18 months were:

Ebooks 4.0 billion dollars, 781 million units

Audiobooks 2.6 billion dollars, 145 million units

Print books 7.3 billion dollars, 407 million units

Roughly half (54%) of print books are sold by brick-and-mortar bookstores in the US. Even if we add print books sold by physical bookstores to the numbers that were achieved by online stores, ebook unit sales nearly match print book unit sales in the US.

The trend identified in the Author Earnings report is the decline of sales via brick-and-mortar bookstores, reduction in the number of physical bookstores, and increasing sales via online stores. Amazon is a dominant player that is still growing its market share in all book formats, also print. In fact, for some nonfiction genres, Amazon accounts 70-75% of all print book sales in the US.

Ebook vs print book market share is highly dependent on genre

Erotica and mystery genres have been regarded the most successful categories in ebooks, and Data Guy’s report confirms the wisdom for mystery genre, at least. Business & Money titles in nonfiction category are more popular as ebooks than print books. The following numbers indicate sales only at online bookstores in the US.

57% of Business and Money category unit sales are ebooks and audiobooks.

59% of these ebooks are published by other than big publishers (such as indies, self-publishers, small publishers). The situation with audiobooks is completely different: 80.6% of audiobooks were made available by big publishers, and 56.5% of print books are from big publishers.

50% of Health, Fitness and Dieting unit sales are ebooks and audiobooks.

62% of these ebooks were published by small publishers, indies and self-publishers. 81.6% of audiobooks were produced by big publishers. 54.7% of print sales were made by big publishers.

73% of Teen and Young Adult unit sales are ebooks and audiobooks.

A massive 71.6% of these ebooks were published by small publishers and self-publishers, whereas 74.7% of audiobooks came from big publishers, and 65.2% of print books were by big publishers.

93% of Mystery, Thriller and Suspense category unit sales are ebooks and audiobooks.

52.9% of ebooks by big publishers, 93.1% of audiobooks by big publishers, 89% of print books big publishers.

Small publishers see opportunities in book formats and genres where the upfront investment is low – often ebooks. Audiobooks and print require more upfront investment, and large companies can afford financial risks better than small businesses.

Data scraping

Ever since Data Guy published his first report on ebook sales that included statistics never seen before, book industry experts have been discussing about the true state of digital book market versus print market. Independent of what you think of Data Guy’s number collection methods (that he calls data scraping), there is plenty of demand for his statistics in the book industry. Bookstat provides detailed reports on book sales for publishers without months of delay. When Bookstat numbers were tested against NPD PubTrack statistics that measure the ebook sales of big publishers in the US, the numbers matched within 6% accuracy.

You can listen to Data Guy himself explaining the data scraping method and other details in a podcast by Mark Dawson.