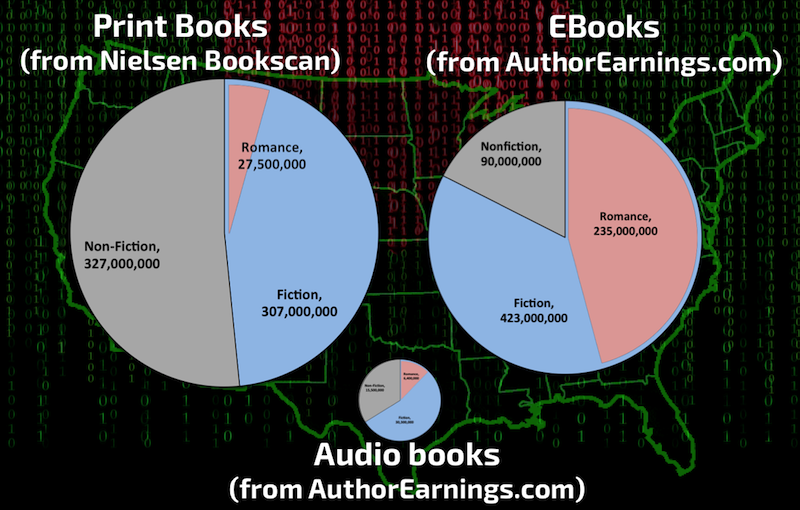

A new report on the state of the ebook, audiobook and print book markets in the US was recently delivered by the number-crunching wizard Data Guy at Digital Book World Conference 2018. The statistics – that cover almost the … Read the story...

Tag: Data Guy

Readers adopted fiction ebooks quicker than non-fiction: Non-fiction ebook market has room to grow

Book market statistics provided by publishing organizations are often quoted as the only authoritative numbers that reflect what is going on in the book trade. Many industry analysts have disagreed with these “official” numbers for years saying that they only … Read the story...