In large parts of the world, only the air you breathe is tax-free. Everything else tends to come with some sort of tax component (I learned this at Venice, Italy where someone was selling ad-supported free maps). The curious thing is that tax systems vary across the world, and even within a country. For instance, in Norway you pay zero value added tax for a printed travel guide of Oslo, but 25% VAT for the same product as an ebook.

In many markets, publishing professionals regard that the higher VAT for ebooks is preventing the new digital economy to flourish. In any case, it doesn’t make sense to tax a modern product that saves trees and transportation costs at a higher rate than a traditional product. In EU, France and Luxemburg have actively tried to lower ebook VAT rates for a couple of years. In 2015, also Germany, Italy and Poland pushed EU to allow lower tax rates for ebooks.

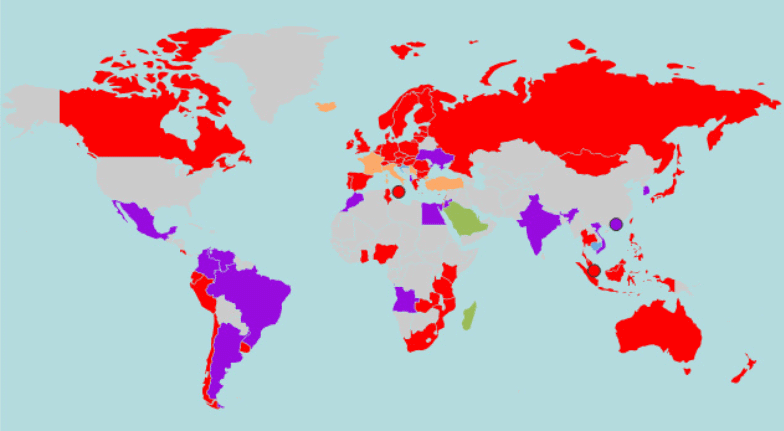

Nonetheless, there are countries that don’t tax ebooks at all, whereas majority of countries apply higher VAT for ebooks than for printed books. Two publishers’ associations, IPA and FEP, mapped out the real situation of VAT policies across the world for ebooks and printed books.

Purple: Zero rate of VAT/GST for ebooks.

Orange: Reduced rate of VAT/GST for ebooks.

Red: Standard rate of VAT/GST for ebooks.

Green: No VAT regime.

Highlights from the survey by IPA and FEP:

Find all the details of the survey here.

Publishing professionals in 79 countries were interviewed for the survey. 36 of them were in Europe, 13 in Asia, 13 in Africa, 9 in Latin America, 5 in the Middle East, plus Canada, Australia and New Zealand. The United States was not included in the survey because each state has its own sales tax regime.

The survey was conducted by two publishing organizations: IPA and FEP. The International Publishers Association (IPA) is a federation of national, regional and specialist publishers’ associations. More than 60 organisations from more than 50 countries in Africa, Asia, Australia, Europe and the Americas are members. The Federation of European Publishers (FEP) is a non-commercial umbrella association of book publishers associations in the European Union.