It is the content that matters. A book is a book regardless of the method you use to read it. A book printed on paper conveys the same ideas, information, excitement and messages as an electronic book enjoyed on a … Read the story...

Tag: VAT

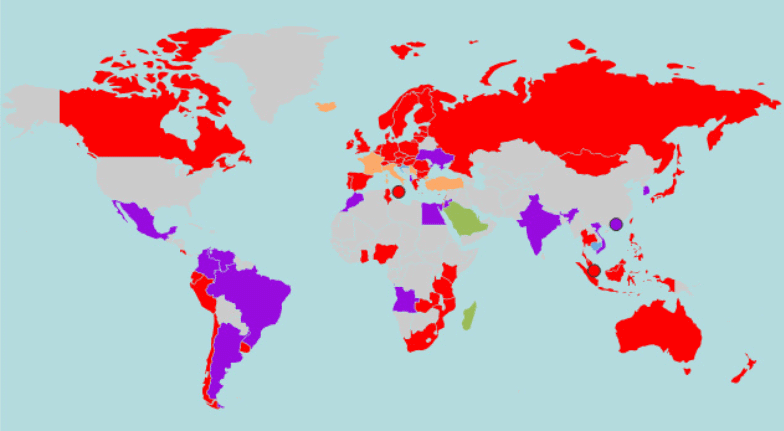

Taxman’s position on ebooks and printed books varies across the world

In large parts of the world, only the air you breathe is tax-free. Everything else tends to come with some sort of tax component (I learned this at Venice, Italy where someone was selling ad-supported free maps). The curious thing … Read the story...